Transact Like A Wall Street Professional And Explode Your Business Like Never Before…

…With Commercial Real Estate’s #1 Business Building Catalyst!

How Do You Learn The Things You Don’t Know You Don’t Know?

As you can probably tell, I’ve worked in this field most of my life.

The main thing I’ve noticed when dealing with investors is this: Many investors have no idea what they’re doing.

And to be totally frank with you, the majority of people in this business simply don’t know what they don’t know.

That isn’t necessarily their fault though. It just so happens that there are many who lack the sophistication needed to transact in the world of high finance, and they don’t know where to turn to get it.

Can you believe that?

A plethora of real estate investment training out there, and still nothing good enough to qualify people and give them the confidence they need to transact effectively.

I know from years of experience it’s MUCH harder to gain trust, close deals, and offer advice to your clients when you can’t speak the language right.

What language?

The language of dealmaking. High finance.

There are specific knowledge points serious investors look for when considering opportunities, and if you don’t know what they are you aren’t going to be successful – simple as that.

My time as a cynical Wall Street investment banker taught me everything I needed to know about high finance, and this knowledge (or “intellectual capital” – as we call it in the business) is something I want every single commercial real estate authority to have access to.

It’s for this very reason that myself and 12 of my industry peers on Wall Street have developed The Association of Capital Placement Agents for Real Estate or ACPARE.

Our goal is to provide each individual investor with the same level of “intellectual capital” and Wall Street transactional training needed to confidently operate and deal with the professionals.

And now, for the very first time, we’ve consolidated all our knowledge into an easy-to-use, completely unvarnished “Wall Street style” training program we like to call ACPARE HQ.

Why ACPARE HQ? 5 Reasons…

ACPARE HQ is for investors who are serious about positioning themselves right and standing out from the hordes of folks who don’t know what they’re doing. With ACPARE HQ, you’re going to be able to…

Who’s It For?

ACPARE HQ is for anyone who’s serious about dealing with the “big kids” in the sandbox of commercial real estate.

My colleagues and I spent the past 24 months carefully engineering this system of structured success.

We’ve essentially distilled all our transactional experiences and commercial investing fundamentals into an easy-to-understand format that ANYONE – regardless of background, real estate experience, or education – can use immediately to architect big profits an any type of real estate opportunity.

So what does that mean for you?

It means that if you’re a real estate fund manager, land developer, financial consultant, intern, analyst, dealmaker, or anything else related to commercial real estate, ACPARE HQ is for you.

This program was originally designed for use with smaller private equity firms and family offices, to effortlessly and inexpensively train their analysts and dealmakers.

It’s an all-inclusive, come-as-you-are type training program.

Have you ever wanted to…

- Speak the cryptic language of commercial dealmaking?

- Master the very same skills expert investors like Trump use every day to capitalize on major investment opportunities?

- Have absolute control of your deal flow and get the most lucrative deal opportunities handed to you on a silver platter?

-

Know how to avoid the most painful and embarrassing real estate investing mistakes before you ever make them?

-

Magnetically attract capital and source major deal opportunities easily and effortlessly?

-

Have continued access to all the commercial real estate tips, tricks, and lingo that the “big boys” use to transact professionally?

-

Know what you’re talking about when speaking with clients, investors, and every type of financial institution?

-

Be taken seriously by peers, colleagues, associates, and everyone else in your industry?

If you nodded eagerly and answered “yes” to any of the above, then I have good news:

ACPARE HQ is for you!

ACPARE HQ is for you!

Step 1: Take the Course

These ACPARE Mastery Courses range from 3 - 8 hours each and come complete with video training lessons and downloadable handouts.

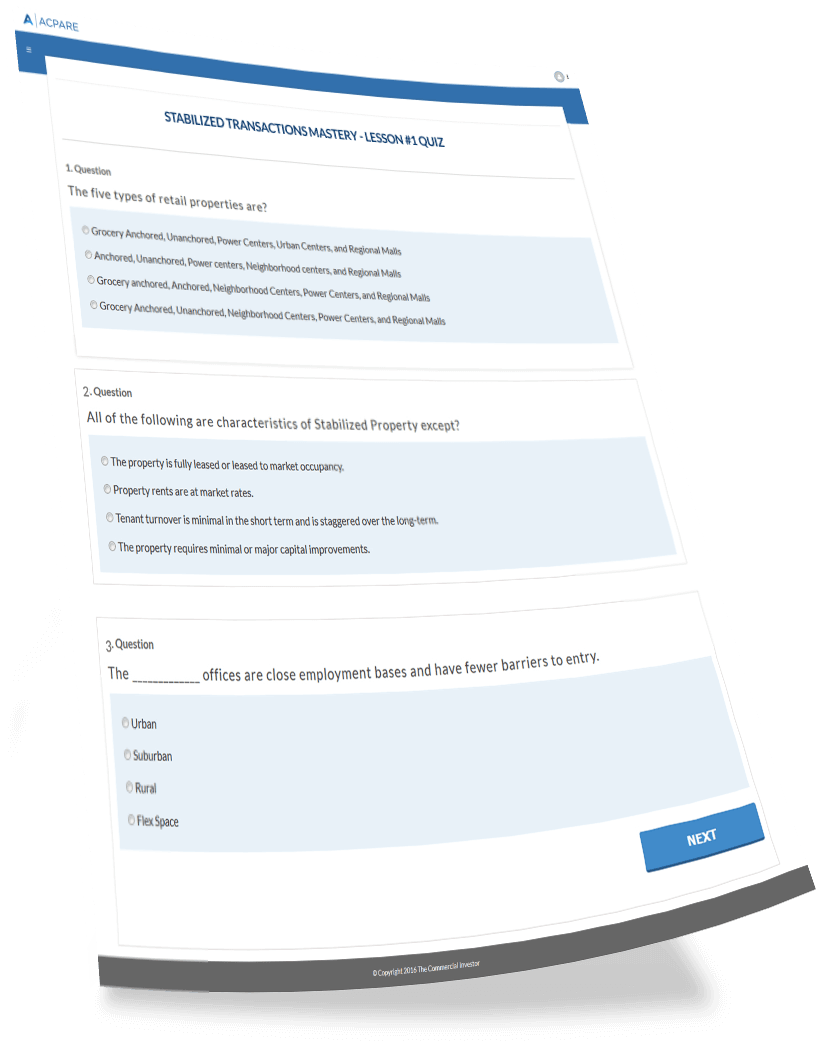

You’ll get flowcharts, blueprints and cheat sheets for quick, easy reference, plus module-specific quizzes and a final exam to test your understanding of the material.

Step 2: Pass the Test

At the end of each module within each ACPARE Mastery Course, you’ll take a brief quiz to ensure that you’ve gained an acceptable understanding of the content and the basic concepts covered in the lesson. Once you’ve completed all the quizzes, you’ll then take an online final exam. Upon successful completion you’ll earn your Transaction Mastery Certification for that specific course. There are 8 in all!

The exams are designed for your dealmaking success. They aren’t necessarily “tricky” (no SAT goofiness), yet they will test your knowledge and comprehension of the material. A passing grade is 80. You can take the exam 3 times, and if you don’t pass after 3 attempts, simply go back through the module prior to taking the test again.

The exams are not timed. They consist of 60 multiple choice and true/false questions. You’ll need to allow 45 to 60 minutes to complete the exam if you plan to complete it in a single sitting. Your exam answers will be saved in the case that you need to finish at a later date.

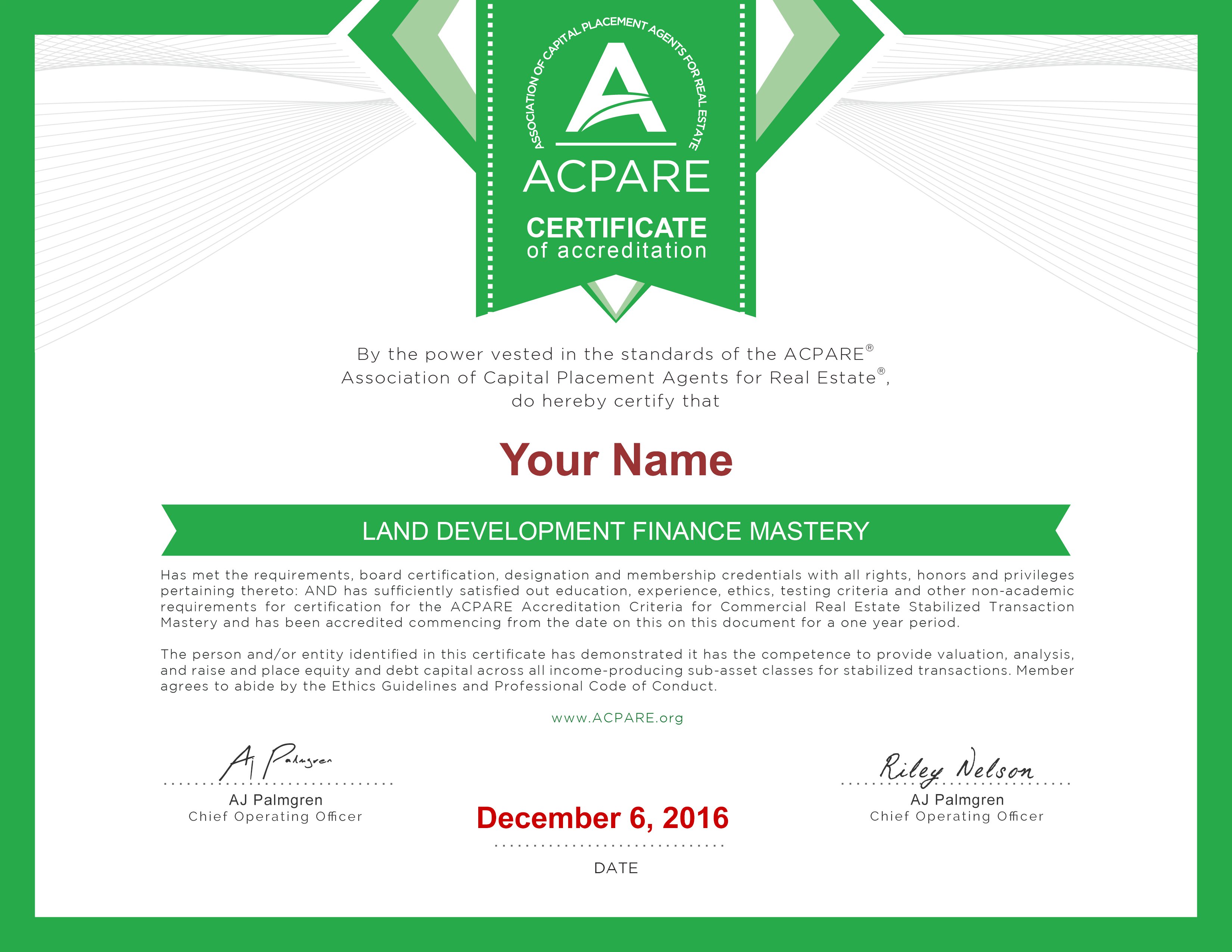

Step 3: Display Your Badge

Upon successful completion of the course and exams, you’ll receive a personalized certificate and digital badge – for each one.

You’ll be able to display your badge on your website, in your email signature, on community portals or your blog, and in your LinkedIn® profile and Twitter status.

And the best part: Your digital certificate is full color – so make sure to print it up, frame it, and display it proudly in your home or office.

These certifications are what will distinguish you in the eyes of your colleagues and competitors, your family and friends.

Display them on your profiles for LinkedIn®, Facebook®, Twitter® and your professional business email as you transact and interact with people.

This is how you’ll set yourself apart from the crowd and amplify your credibility and prestige in the eyes of everyone you meet.

Gain Access To The World’s Most Thorough Wealth Generation Library – Bursting With Critical Intel And Strategies To Maximize Your CRE Investing Success

Stabilized Transaction Mastery

(Value: $997)

The easiest transaction types to raise private money around.

Stabilized properties are the SAFEST and most sought after, in demand commercial assets in ANY market. No matter how big or how small.

(Yes, there is more to commercial than apartments….)

In Stabilized Transactions Mastery you’ll learn about how to value these 4 Food Groups; lease structures and terms; debt structures; rent roll analysis; how to acquire, assume, sell, and invest in these bond-like investments; and how to use our models to pinpoint profitability before making any further investment of your time or money.

Value-Added Transaction Mastery

(Value: $997)

Rehab. For commercial.

Value-added transactions are huge wealth creators. However, this is only true if you have the step-by-step plan on how to analyze these projects – only then will the process become very clear to you. This course will provide you with the clarity and leadership you need to bring your deal to a close.

This mastery program discusses the following in depth:

- How to define value-added investments (and what differentiates them from other transaction types)

- The investor transaction selection criteria you are expected to know...

- “Good” deals vs. “bad” deals (the compare and contrast model)

- How to add value to the property (remember: not all repairs add value!)

- Types of financing used for acquiring and exit sizing for takeout permanent loans

In Value Added Mastery you’ll learn how to use our proprietary models to analyze, place capital, raise capital, or arbitrage value-added deals across the 4 Food Groups.

Joint Venture and Fund Structure Mastery

(Value: $997)

When do you need a fund and when do you need to use a joint venture structure?

The key to achieving success here is finding the right partner and understanding how to correctly form the JV and the fund. This mastery explores the different types of equity investors and focuses on how to start a fund – regardless of your experience level.

This mastery program discusses the following in depth:

- What a joint venture partner is and examples of JV partners

- A comparison of the joint venture equity partnership vs. the fund structure.

- What it means to form a “good” partnership

- The key drivers in each structure, such as promotes, discretion, term of the partnership, leverage, crossed promotes, and realization timelines

-

Who’s who? (LPs vs. GPs vs. Institutional Equity, pari pasu alignment, and more…)

Land Development Mastery

(Value: $997)

How do you value a piece of dirt? Very few know how…

Land can be a tremendous wealth creator, but only if you know what you’re looking for and only when you’re able to engineer the deal properly.

This mastery program discusses the following in depth:

- The key metrics used to value land

- How to properly conduct land due diligence

- Creating a plan for structuring your land deal

-

How to finance any land deal (capital structure for land)

-

A comparison of land uses and the most profitable land types

- How to conduct residential and commercial residual analyses

Commercial Due Diligence Mastery

(Value: $997)

The devil is always in the details that you DON’T know about…

This mastery program discusses the following in depth:

Condominium Investing Mastery

Like IPOs, the best time to buy condos is BEFORE they are made available to the public…

This mastery program discusses the following in depth:

- The key metrics used to value condominiums

- How to conduct condominium due diligence.

- Different options for financing condo deals

-

Condo types and all the factors to consider before investing

-

Figuring out condo ROI and finding the right deal

- Determining condo value and due diligence factors specific to the asset class

Commercial Capital Structure Mastery

(Value: $997)

Those sexy cocktail terms everyone loves to say, but only a very few know about…

This mastery program discusses the following in depth:

Commercial Opportunistic Transaction Distressed Investing Mastery

(Value: $997)

It’s a well-known fact: Other people’s pain is your gain in commercial…

This mastery program discusses the following in depth:

-

The 7 key reasons why deals go bad (and how to spot them quickly and easily)

- The distressed asset lifecycle: where the greatest risk is and how to price it

- Types of commercial defaults and their severity

- Buying the distressed note

- Bankruptcy (and how you profit from it)

- Chapter 11 debtor-in-possession loans

- Successful deal structuring around distressed commercial assets

Why Do I Need It?

No monetary sum compares to the true wealth of knowledge you’ll soon have access to.

ACPARE HQ is filled with strategies my peers and I have worked our whole careers to develop and real estate investing secrets that have never before been released to the public.

You’re going to be exposed to all types of deals and situations during your real estate career, and it pays to know how to handle them.

What would you give to position yourself as the ultimate authority in any circumstance you may find yourself?

Or know how to magnetically attract capital and source meaningful opportunities 100% of the time?

ACPARE HQ will let you do just that.

Real estate investing is going to become second nature to you.

You’ll have total, continued access to my ultimate investing library for all 8 of the major CRE disciplines and you’ll be able to pick and choose what kind of opportunities you’re going to pursue. An absurd amount of knowledge and “intellectual capital” is right there at your disposal, just waiting for you to take advantage of it.

What’s It Going To Cost?

Most investors prefer to stick with one asset class rather than branch out and explore other opportunities, but for the real players in this business that just doesn’t make sense. Why limit yourself to one corner of the court and stand there watching for the whole game when there are so many chances to jump in elsewhere?

That’s why you’re going to get unlimited access to all 8 of our ACPARE HQ Mastery Classes at once – so that you can multiply your successes with other opportunities and build wealth in different asset classes. The core purpose of ACPARE is to give every investor a chance to jump into real estate the Wall Street way, with a well-rounded knowledge base and opportunities to succeed in a variety of different arenas.

So to make sure that happens and that this is affordable for everyone, I’ve decided to charge a standard rate of $299/month for full ACPARE HQ access. This includes access to all the official classes, coursework, quizzes, and – of course -- our world-class ACPARE accreditation.

What’s more, there are no hidden costs. No paying extra if you’re taking too long in a course or decide you don’t want to learn anything today. No worries. So long as you keep up your monthly subscription you’ll have total access to everything and you’ll be able to work through the trainings at your own pace, whenever you’d like. No pressure to finish classes within a certain timeframe or earn your certificate faster than you’re comfortable with.

$299/month includes full team access as well. Train yourself, your team, your interns, your dog – whoever’s considered part of your immediate office and vital to your success as an investor. (So long as they’re actually part of your team, of course. I don’t want this wealth of information just being handed out willy-nilly…)

When you complete a course successfully and receive your official ACPARE Certificate and Badge you’ll be considered an ACPARE Accredited Investor. Congratulations! That will last for one full year. Then you’ll need to retake the quiz again just to make sure nothing’s changed and that your knowledge is all up-to-date. You don’t have to redo the full course or any of the lessons, just prove that you still know what you’re talking about and are qualified to bear the ACPARE name.

$299/month is nothing compared to the amount of wealth you’re going to generate just by having access to the full ACPARE HQ training library. The opportunities to branch out, learn new tricks, and build your success with all areas of your commercial real estate repertoire extend far and wide.

The only thing that’s going to stop you from taking advantage of this enormous wealth of opportunity? You. Don’t get in the way of your future success or settle for anything less than what you’re capable of.

Learn How To Architect Profits From Opportunities In All 8 Major CRE Disciplines Today

Still Not Convinced ACPARE HQ Is For You?

There are a plethora of other real estate training programs out there, most of which involve poorly-executed “get rich quick” schemes or gurus promising shortcuts to riches.

In other words, there are a lot of “clickbait style” offers aimed at tricking people into buying a product that just can’t deliver on its promises.

ACPARE HQ makes no “get rich quick” guarantees or promises of instant gratification. It gives you the tools that will ultimately lead you to wealth and riches, but you have to put in the work first. Just like earning your doctorate, building a business, or doing anything else worthwhile in life, you’re going to get out of it what you put in.

And with ACPARE HQ, that effort is going to pay off over and over again. Wherever you are in your business or career path right now, you’re going to start to see real, organic progress when you invest your time and yourself into this program.

Success is a given with this kind of specific, tactical training.

What’s more, the associated ACPARE accreditation is huge. When you pass an ACPARE Mastery Class and become certified in one of the 8 major CRE disciplines, you make a choice to set yourself apart from every other “cut and paste” investor in the crowd. You send a crystal clear message to your prospects that you have a thorough understanding of their needs and concrete solutions to their problems.

So what’ll ACPARE HQ do for you? It’ll show you how to engineer profits like clockwork, all the parts moving together to ensure your commercial real estate investing success. That, and so, so much more…

My advice is this: Act today. Get access to the only commercial real estate training program that will solidify your success and cannonball you into the #1 position in any market you want to control.

I can promise you it’ll be the best decision you ever made.

Salvatore M. Buscemi

Founder and CEO, The Commercial Investor

Co-Founder and Managing Director, Dandrew Partners, LLC

Get Continued Access To My Complete Library Of Time-Tested Methods and CRE Success Strategies Now

Frequently Asked Questions (FAQ)

Q: How will the ACPARE certification program help me?

A: Most commercial investors learn by the seat of their pants. They hack their way through learning the ropes the hard way… through trial and error. And because there’s no system in place or way to test their knowledge of what they know, they either quit or burnout.

The certification program sets you on a deliberately designed and calculated path to success. You get a step by step training process to help you accelerate your learning curve and course of action.

So your certificate is actually a badge of accomplishment and achievement for taking the time to learn the content and material that helps you build your business AND bring in revenue in the shortest, quickest time possible.

There’s no mistaking who you are and what you represent to your prospects and clients when you’re certified. You BECOME the expert in their eyes. You ARE that trustworthy advisor, consultant, dealmaker, and intermediary. You become the one person they can truly rely on for guidance.

Display your badge and certificate proudly… and witness the results for yourself.

Q: How long does it take to finish an ACPARE course and receive my certification?

In my experience, it’s best to set aside a few hours and go through as many modules and quizzes as possible in each sitting. This way you COMMIT to absorbing all you can and finishing the course with a set deadline in place. It’s best to avoid dragging it out over weeks or months.

Remember, an ACPARE course itself is only 8 hours. You can complete it in a day if you choose. Ideally it’ll take 3-7 days if you devote yourself to it full-time or 14 days if you commit to it part-time.

If for any reason you can’t start training right away or you have to put a course aside due to other commitments, no worries. The training is there for you 24/7 so long as your subscription remains up-to-date.

Q: Am I guaranteed a certificate and badge if I take an ACPARE Mastery Class?

A: No. You must pass the quizzes and final exam to get certified. It’s only fair to your clients and prospects that you know how to best serve them. Trying to buy an ACPARE certification is like purchasing a diploma from Wharton or Harvard. It just doesn’t work that way.

Your certificate represents the time and effort you put into the course and demonstrates your full comprehension of the material. If that weren’t the case then your certificate wouldn’t be worth the paper it was printed on.

Q: How difficult is an ACPARE Mastery Class test?

The quizzes and exams are designed to test your knowledge on the lessons you take. The questions are in no way intentionally designed to “trick” you. I have every confidence that when you go through these lessons, take notes, and focus (without distractions… like browsing websites, surfing Facebook, answering phone calls, etc.), you’ll do just fine.

Are the questions challenging? Yes. Anything worth doing is worth doing well. If it were easy everybody would be doing it. The strategies and insights you get with this training are proprietary, not like other commercial real estate courses you may have taken. This material will really distinguish you from your peers and the competition and the quiz questions for a specific ACPARE course are going to reflect your total comprehension of that arena.

Q: What if I fail an ACPARE exam? Can I retake it?

A: Absolutely. You can take any ACPARE test up to 3 times. If you don’t pass the exam after the third attempt, you’re required to retake the training… which you can do for free…plus all the lessons and quizzes prior to taking the final exam.

Launch Yourself To The Summit Of Your Commercial Deal Structuring Career Today

Have Questions? Feel Free To Contact Us Using Our Support Center

Copyright © 2017. The Commercial Investor. All Right Reserved. - Terms & Conditions - Earnings Disclaimer - Privacy Policy