Finally, How To Become a Legitimate, and Respected Land Developer

...Who Can Value, Structure and Raise Capital For Any Land Deals and Generate Enormous Wealth…

...Who Can Value, Structure and Raise Capital For Any Land Deals and Generate Enormous Wealth…

Without Risk To You And Your Investors

Finally! In only a few moments you’ll have the Fully

Consolidated Land Valuation Toolkit to…

Consolidated Land Valuation Toolkit to…

Successfully Invest in One of

the Most Profitable

Commercial Opportunities of

Today: Land Deals

the Most Profitable

Commercial Opportunities of

Today: Land Deals

Land deals: they’re involved, they’re messy, and most of the time they simply aren’t

worth the hassle. Right?

worth the hassle. Right?

WRONG. Land deals hold some of the greatest wealth-building opportunities in commercial real estate today. When managed properly, land deals can be fairly hassle-free and a more lucrative wealth-building opportunity than any other type of commercial real estate transaction.

Well why isn’t everyone investing in land deals, then?

Good question. Here’s the reason: Many investors avoid the unending gold mine of commercial real estate land transactions for one reason, and one reason only…

They have absolutely no idea what they’re doing.

Many see all the profit to be made from land investments, they see the “big boys” purchasing and developing land, and they think to themselves, “Why can’t I do that?”

Well, see, here’s our little secret...

YOU ABSOLUTELY CAN INVEST IN LAND DEALS AND—WITH THE HELP OF THESE NEVER BEFORE RELEASED TRICKS & TOOLS – YOU CAN GENERATE COLOSSAL WEALTH WHILE DOING SO

That’s right. These opportunistic transactions are easier than you think – easier to structure, easier to manage, and easier for you to emerge with a monumental payoff.

It all has to do with valuing the land beforehand: seeing the development potential and investing accordingly.

Not only will this ACPARE Certified Land Development Mastery kit give you the skills to discover the future profit potential in every land opportunity, but it’ll grant you the confidence you need to move forward with your acquisitions and earn the mammoth paydays you’ve been waiting for.

You can thank us later; after all, your dealmaking success is what we’re here for.

Just as every handyman needs a toolkit, so too does every aspiring and experienced dealmaker need a tried, tested playbook to walk them through the intricacies of structuring deals – to show them how to find value where few can find it.

DON’T BE THE EXPERIENCED

DEALMAKER WHO SITS BY THE SIDELINES WHILE THOSE WHO ARE LESS CREDIBLE AND LESS QUALIFIED THAN YOU RUN THE COMMERCIAL REAL ESTATE

GOLDMINES DRY

DEALMAKER WHO SITS BY THE SIDELINES WHILE THOSE WHO ARE LESS CREDIBLE AND LESS QUALIFIED THAN YOU RUN THE COMMERCIAL REAL ESTATE

GOLDMINES DRY

Act now and become ACPARE certified. Trust us: You’re worth it.

And, if you still aren’t convinced, here’s some of the many ways in which ACPARE’s Certified Land Development Mastery Class will empower you to:

As you probably know by now, becoming an ACPARE Certified Land Transaction Investment Specialist will allow you to gain the prestige most commercial investors only dream about. Completion of this Expert-Level Mastery Class will render you able to make informed and intelligent investment decisions, gain unprecedented amounts of credibility, and command the highest fees in the business.

To become a Complete ACPARE Certified Land Transaction Investment Specialist now, simply choose your program below and follow 3 Easy Steps…

How Does It Work?

Step 1. Take the Course

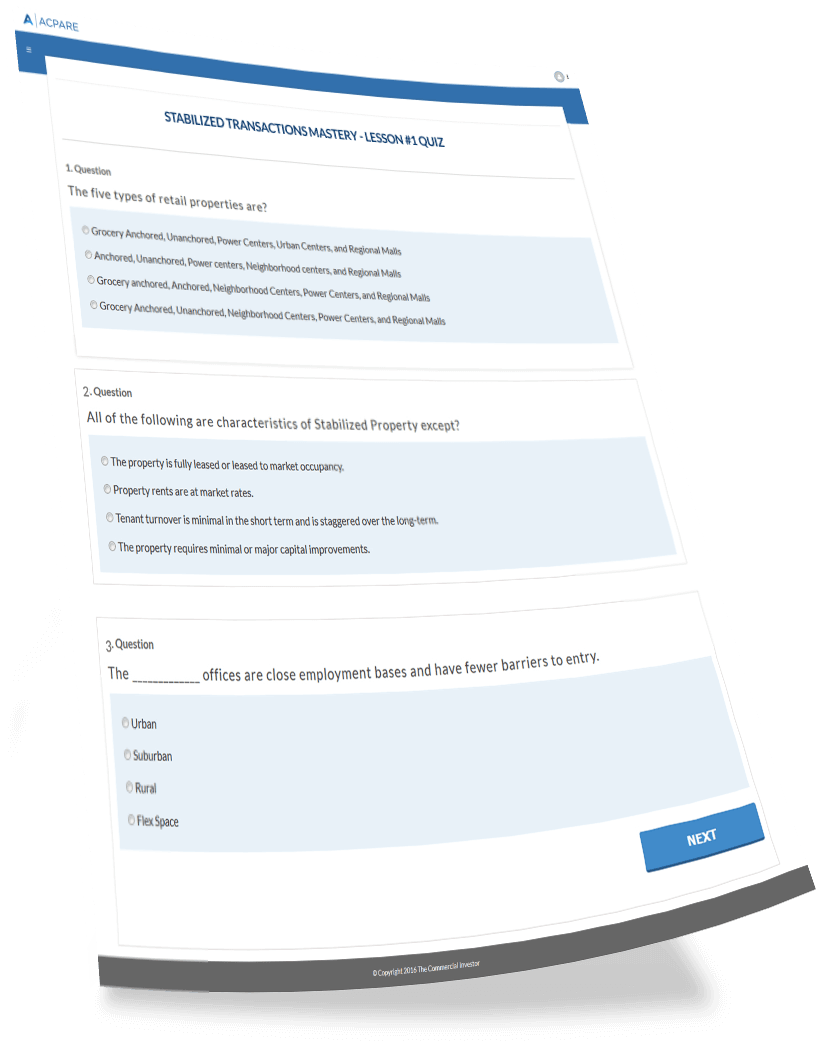

The Land Development Finance Mastery course is 8 hours of video training lessons plus 6 handout downloads. You also get flowcharts and cheat sheets for quick, easy reference, plus 7 module-specific quizzes and a final exam.

Step 2. Pass the Test

Step 3: Display Your Badge

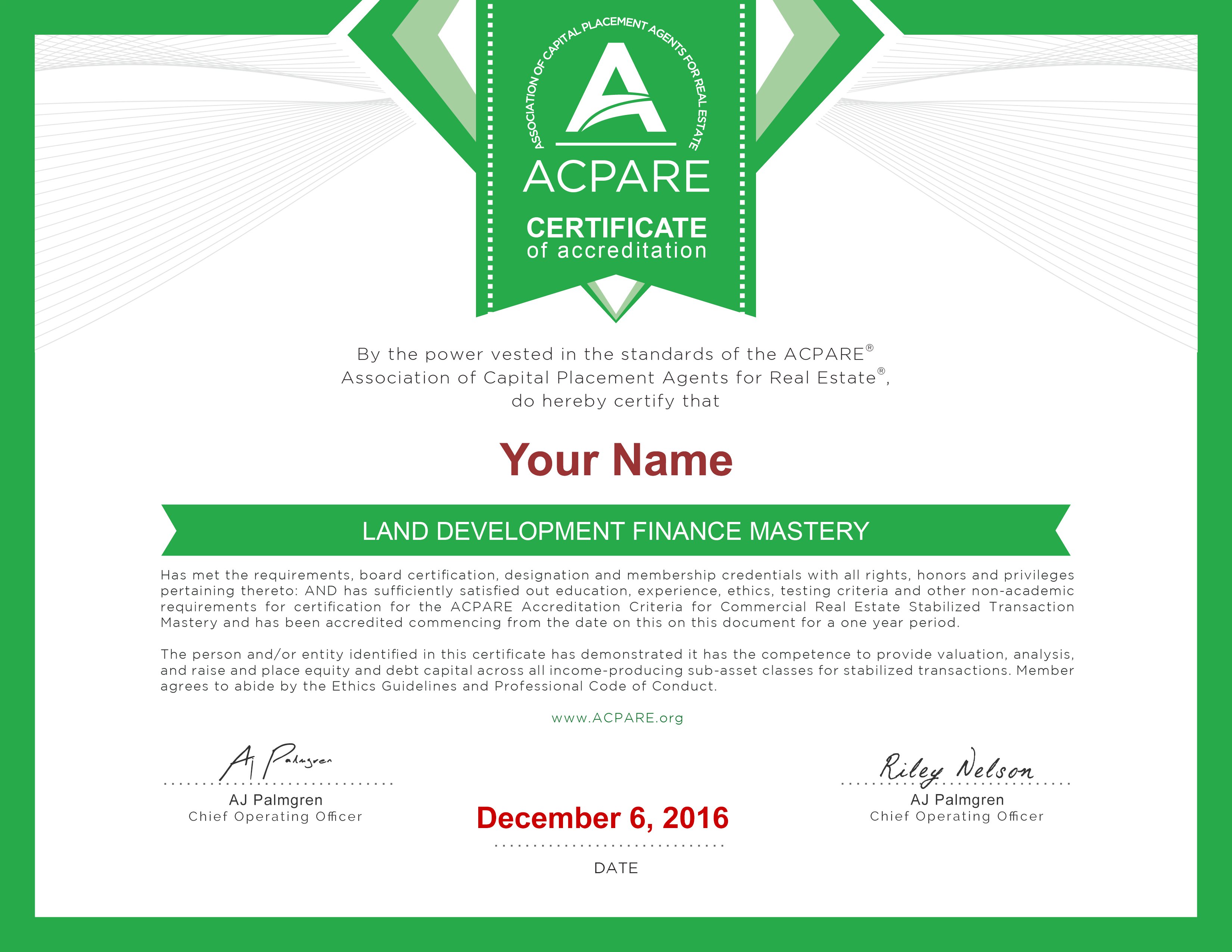

Upon successful completion of the course and exams, you’ll receive a personalized certificate and badge.

Display your badge on your website, in your email signature, community portals, on your blog, and especially in your Linkedin profile and Twitter status.

AND…your digital certificate is full color, so print it up, frame it, and display it proudly in your home and office.

Display your badge on your website, in your email signature, community portals, on your blog, and especially in your Linkedin profile and Twitter status.

AND…your digital certificate is full color, so print it up, frame it, and display it proudly in your home and office.

Become a Certified Land Development Finance Specialist Today!

Here’s What You Get

When you enroll today, you’ll get:

- The Land Development Transaction Total Mastery Course

- 5 Core Lessons

- 24 Modules

- 6 Handouts

- 6 Blueprints

- 5 Review Quizzes

- The Full, Easy-To-Reference Land Development Transaction Manual

- 2 Excel Modelers with Video Tutorials: Residential Sale Exits, and Commercial Sale/Leasing Exits

PLUS, upon successful completion of the course and all the quizzes and final exam you’ll receive:

- A Wall Street-grade ACPARE badge –– designating you as a Certified Land Transaction Master –– that you can display on/in your website, email signature, Facebook® and LinkedIn® profile

- A downloadable ACPARE certificate, to be displayed digitally

- A dated and displayable ACPARE Certificate of Accreditation, signed by head executives and mailed directly to your home or workplace

- Status, acclaim, and recognition as an ACPARE Certified Land Development Transaction Specialist

Course Details:

Tuition: Just $995!

Level: Intermediate / Advanced

Setting: Online / Virtual

Course Length: 8 hours

Expected Completion Time: 3-7 Days

Level: Intermediate / Advanced

Setting: Online / Virtual

Course Length: 8 hours

Expected Completion Time: 3-7 Days

Who Should Get Certified?

Certification is for anyone looking to command premium fees for capital placement, deal making, and their services when it comes to transacting and consulting on stabilized property investments. Your positioning in the marketplace matters. Like it or not, your prospects and clients WANT to do business with credible business owners they can trust.

Who Is Certification For?

- Startup investors

- Deal Makers

- Intermediaries

- Commercial Consultants

- Private Lenders

- Owners & Operators

- Sponsors

- Contractors

- Property Managers

- Anyone who knows Credibility matters

Why Should You Get Certified?

You get the same strategies, insider intel, tools, techniques, and resources we use in our business. All of it proven and time-tested.

So if you want to…

So if you want to…

- Get expert training and guidance

- Build a business you can be proud of AND get noticed

- Feel confident knowing that you’re qualified and prepared to quickly take on clients and projects

- Rise above the fold and distance yourself from the competition

- Attract ONLY high quality clients

- Know how to expertly parlay your intellectual capital

- Structure deals like a Wall Street pro

-

Charge highly lucrative fees for your advice and consultation…

When everyone on your team is in synch, can understand what you—their leader—is doing and thinking, productivity and incentive skyrockets.

With everyone in your office on the same page, using the same language, and possesses the same skills, your company becomes a formidable force in the marketplace.

Keep this in mind…there’s no rule that says you have to get certified or take the test.

You still have all the great content, training, and modules to enhance your team’s education. And the more specialized they are, the more you can charge for your services.

Whatever you choose, if you expect the best for your company and the most from your team, then this course and certification is for you.

With everyone in your office on the same page, using the same language, and possesses the same skills, your company becomes a formidable force in the marketplace.

Keep this in mind…there’s no rule that says you have to get certified or take the test.

You still have all the great content, training, and modules to enhance your team’s education. And the more specialized they are, the more you can charge for your services.

Whatever you choose, if you expect the best for your company and the most from your team, then this course and certification is for you.

...is Different

Are there other courses out there on Stabilized Property investing? Probably. But you won’t find anything that comes close to what you’ll get with this training.

The difference is, all of us here at The Commercial Investor, including our students and partners, are actual investors, in the trenches every day.

We raise capital, place capital, analyze and structure deals, buy and sell property, negotiate with institutions, family offices, and lenders, and pitch the ‘big boys.’

So…does this sound exciting to you? Is this something you want to be part of? If your answer is ‘yes,’ then you’re in the right place.

The difference is, all of us here at The Commercial Investor, including our students and partners, are actual investors, in the trenches every day.

We raise capital, place capital, analyze and structure deals, buy and sell property, negotiate with institutions, family offices, and lenders, and pitch the ‘big boys.’

So…does this sound exciting to you? Is this something you want to be part of? If your answer is ‘yes,’ then you’re in the right place.

Course Details

Lesson 1: Start Here

Section 1.1 - Orientation

Section 1.2 - Here’s What to Expect

Section 1.3 - Asset Types

Section 1.4 - The Total Real Estate Capital Strategy

Section 1.5 - Stabilized Properties: The What and Why

Section 1.6 - Rules of Investing

Section 1.7 - Sample Transaction: Stabilized Property Example #1

Section 1.8 - Sample Transaction: Stabilized Property Example #2

Section 1.2 - Here’s What to Expect

Section 1.3 - Asset Types

Section 1.4 - The Total Real Estate Capital Strategy

Section 1.5 - Stabilized Properties: The What and Why

Section 1.6 - Rules of Investing

Section 1.7 - Sample Transaction: Stabilized Property Example #1

Section 1.8 - Sample Transaction: Stabilized Property Example #2

Lesson 2: Real Estate “Whole Loan” Financing Continuum: The Lenders

Section 2.1- Real Estate Risk

Lesson 3: The Different Types of Real Estate Properties: The Assets

Section 3.1 - Stabilized Properties

Section 3.2 - Unstabilized or Value Added Properties

Section 3.3 - Opportunistic Properties

Section 3.2 - Unstabilized or Value Added Properties

Section 3.3 - Opportunistic Properties

Lesson 4: What is Permanent Financing?

Section 4.1 - Definition

Section 4.2 - Typical Permanent Financing Structure

Section 4.3 - Repaying the Permanent Loan

Section 4.2 - Typical Permanent Financing Structure

Section 4.3 - Repaying the Permanent Loan

Lesson 5: Types of Permanent Financing

Section 5.1 - Life Company or Portfolio Loans

Section 5.2 - Bank Loans

Section 5.3 - Commercial Mortgage Backed Securities (CMBS) or Conduit Loans

Section 5.4 - Agency Lenders: Freddie Mac (FHLMC), Fannie Mae (FNMA), & FHA/HUD

Section 5.2 - Bank Loans

Section 5.3 - Commercial Mortgage Backed Securities (CMBS) or Conduit Loans

Section 5.4 - Agency Lenders: Freddie Mac (FHLMC), Fannie Mae (FNMA), & FHA/HUD

Lesson 6: Analyzing Stabilized Properties

Section 6.1 - From the Owner’s Perspective

Lesson 7: Property Profitability

Section 7.1 - Cash-On-Cash Return

Section 7.2 - Leveraged Cash-On-Cash Return

Section 7.3 - Positive Leverage

Section 7.2 - Leveraged Cash-On-Cash Return

Section 7.3 - Positive Leverage

Lesson 8: How Much Leverage Will this Building Support?

Section 8.1 - Cap Rates: The Key to Income Property Value

Section 8.2 - Loan to Value: The Lender’s Key Metric

Section 8.3 - Debt Service Coverage Ratio (DSCR): Another Key Lender Metric

Section 8.4 - Amortization or Loan Constant

Section 8.5 - Solving for the Loan Constant

Section 8.2 - Loan to Value: The Lender’s Key Metric

Section 8.3 - Debt Service Coverage Ratio (DSCR): Another Key Lender Metric

Section 8.4 - Amortization or Loan Constant

Section 8.5 - Solving for the Loan Constant

Lesson 9: Permanent Loan Underwriting: Deep Dive on How the Numbers Work

Section 9.1 - Underwriting the Stabilized Loan

Section 9.2 - Tenant Assumptions

Section 9.2 - Tenant Assumptions

Lesson 10: Solving for the “Underwritten NOI”

Section 10.1 - Deductions

Lesson 11: Asset Class Review: All Commercial Properties Were Not Created Equal

Section 11.1 - Office Properties

Section 11.2 - Retail Properties

Section 11.3 - Industrial

Section 11.4 - Multifamily

Section 11.2 - Retail Properties

Section 11.3 - Industrial

Section 11.4 - Multifamily

Lesson 12: Conclusion & Looking Ahead

Section 12.1 - Conclusion

Course Details and Description

Lesson 1: Start Here

- 1.1 Orientation

- 1.2 Here’s What to Expect

- 1.3 Types of Commercial Real Estate Transactions

- 1.4 The Total Commercial Real Estate Strategy

- Capital Placement

- Asset Arbitrage

- Capital Formation

- 1.5 Sponsor and Sponsorship Equity

- Sponsorship Equity Co-Investments

- Guidelines for Sponsor Co-Investment

- Where is the Equity Really Coming From?

Lesson 2: Land Overview

- 2.1 Land Types

- 2.2 Sample Transaction – Residential Land

- 2.3 Sample Transaction – Commercial Land

- 2.4 The Land Continuum

- 2.5 Land Basics

- 2.6 Land Investing Characteristics

- 2.7 Land Investment Strategies

- 2.8 Land By the Numbers

Lesson 3: Land, Politics, and Risk

- 3.1 Land Rights

- 3.2 Land Development Risk

Lesson 4: Land Due Diligence & Land Financing and Investment Characteristics

- 4.1 Due Diligence Factors

- 4.2 Land Financing and Investment Characteristics

- 4.3 Land Financing Options

- 4.4 Purchasing Land

- 4.5 Structuring the Land Acquisition Transaction

- 4.6 Establishing the Value of Land

Lesson 5 : Land Development Issues and Land Valuation

- 5.1 Development Issues

- 5.2 Interim Land Uses

- 5.3 Land Valuation

And, if you still aren’t convinced, here’s some of the many ways in which ACPARE’s Certified Land Development Mastery Class will empower you to:

Become a Certified Land Development Finance Specialist Today!

Your Instructor: Sal Buscemi

Sal Buscemi is the CEO of The Commercial Investor and managing partner of Dandrew Partners in NYC.

A former investment banker for Goldman Sachs in NYC, Sal left the company after 8 years to start his own commercial real estate hedge fund.

He raised $30 Million within 6 months. Sal has since raised close to $150 Million in capital for various private money pools and the JG Mellon fund.

Sal founded Dandrew Partners and Dandrew Media as vehicles for investing in real estate and publishing educational content for serious investors. His passion for teaching is rivaled only by his excitement to see his students succeed.

A former investment banker for Goldman Sachs in NYC, Sal left the company after 8 years to start his own commercial real estate hedge fund.

He raised $30 Million within 6 months. Sal has since raised close to $150 Million in capital for various private money pools and the JG Mellon fund.

Sal founded Dandrew Partners and Dandrew Media as vehicles for investing in real estate and publishing educational content for serious investors. His passion for teaching is rivaled only by his excitement to see his students succeed.

Frequently Asked Questions

Q: “How will this certificate help me?”

Q: How long does it take to finish the course and receive my certification?

A: That depends on you and your schedule. There’s no time constraint. You can go at your own pace. At the end of each module, you take a quiz.

In my experience, it’s best to set aside a few hours and go through as many modules and quizzes as possible in each sitting. This way, you COMMIT to absorbing all you can and finishing the course with a set deadline in place. Avoid dragging it out over weeks or months.

Remember, the course itself is only 8 hours. You can complete it in a day if you choose. Ideally, 3-7 days if you devote to it full time, 14 days if you commit to it part time.

If for any reason you can’t start the training right away after you invest in it, or you have to put it aside due to other commitments, no worries. The training is there for you for however long you need it.

In my experience, it’s best to set aside a few hours and go through as many modules and quizzes as possible in each sitting. This way, you COMMIT to absorbing all you can and finishing the course with a set deadline in place. Avoid dragging it out over weeks or months.

Remember, the course itself is only 8 hours. You can complete it in a day if you choose. Ideally, 3-7 days if you devote to it full time, 14 days if you commit to it part time.

If for any reason you can’t start the training right away after you invest in it, or you have to put it aside due to other commitments, no worries. The training is there for you for however long you need it.

Q: Am I guaranteed a certificate and badge if I take the class.

A: No. You must pass the quizzes and final exam to get certified. It’s only fair to your clients and prospects that you know how to best serve them. You can’t buy a certification, much like you can’t buy a diploma from Wharton or Harvard.

Your certificate represents the time and effort you put into the course, and your understanding of the material. I that weren’t the case, your certificate wouldn’t be worth the paper it was printed on.

Your certificate represents the time and effort you put into the course, and your understanding of the material. I that weren’t the case, your certificate wouldn’t be worth the paper it was printed on.

Q: I don’t care about the certificate. Can I just audit the class?

A: The class and certification are bundled for $995. And you’re also eligible to take the exam up to 3 times. This will change soon and when it does, the price will also increase. We are not currently offering audits of the class.

Q: How difficult is the test?

The quizzes and exams are designed to test your knowledge on the lessons you take. The questions were in no way intentionally created to “trick” you. I have every confidence that when you go through the lessons, take notes, and focus (without distractions…like browsing websites, surfing Facebook, answering phone calls), you’ll do fine.

Are the questions challenging? Yes. Anything worth doing is worth doing well. If it were easy, everybody would be doing it. The strategies and insights you get with this training are proprietary, not like other commercial courses you may have taken. The material will help you stand out from your peers and the competition, and the quiz questions will reflect and support you in that arena.

Are the questions challenging? Yes. Anything worth doing is worth doing well. If it were easy, everybody would be doing it. The strategies and insights you get with this training are proprietary, not like other commercial courses you may have taken. The material will help you stand out from your peers and the competition, and the quiz questions will reflect and support you in that arena.

Q: What if I fail the exam? Can I retake it?

A: Absolutely. You can take the test up to 3 times. If you don’t pass the exam after the third attempt, you’re required to retake the training…which you can do for free…plus all the lessons and quizzes prior to taking the final exam.

Become a Certified Land Development Finance Specialist Today!

Copyright © 2017. The Commercial Investor. All Right Reserved. - Terms & Conditions - Earnings Disclaimer - Privacy Policy