How To Become a Fearless and Respected Value Added Transactional Specialist…

Fit to Extract GARGANTUAN Profits As an

Experienced and Credible Owner/Operator

Experienced and Credible Owner/Operator

Finally! In Only a Few Moments You’ll Have the Fully

Consolidated Value Added Transactional Toolkit to…

Consolidated Value Added Transactional Toolkit to…

Detect the Concealed Profit Potential in Every Value Added Commercial Opportunity

Value-added real estate transactions are the apex of profit potential when it comes to commercial deals, as they pose the most risk and thus possess the greatest wealth-building opportunity in the commercial world. Experienced owners and operators are the key to success in value-added deals, as — while bad operators will make good deals go bad — skilled operators will take questionable deals and make them profitable.

But, you might be wondering…

- What distinguishes a “good” sponsor from a “bad” one?

- How can I make sure I possess enough intellectual capital to make ENORMOUS profits when investing in value-added properties?

- What tools do I need to make use of one of the greatest opportunities ever to exist within the commercial real estate world?

Well, you need not wait any longer. This course has been designed specifically to answer those very questions, and to lead you into the lighted realm of value-added properties armed with every tool, formula, and property-analyzing equation you’ll need for success — backed with the promise of COLOSSAL profits when you follow ALL these straightforward steps to decrease risk and avoid toxic commercial deals.

IF YOU DON’T KNOW HOW A

SEASONED, QUALIFIED, AND SUCCESSFUL VALUE-ADDED SPONSOR THINKS AND ACTS NOW, BELIEVE US... YOU WILL UPON COMPLETION OF THIS EXPERT LEVEL MASTERY CLASS

SEASONED, QUALIFIED, AND SUCCESSFUL VALUE-ADDED SPONSOR THINKS AND ACTS NOW, BELIEVE US... YOU WILL UPON COMPLETION OF THIS EXPERT LEVEL MASTERY CLASS

…In fact, you’ll be thinking just like one.

And, in case you weren’t aware, ACPARE™ (Association of Capital Placement Agents for Real Estate) is the nation’s gold standard for experienced-based commercial real estate investment training and accreditation.

Just as every handyman needs a toolkit, so too does every aspiring and experienced dealmaker need a tried, tested playbook to walk them through the intricacies of structuring deals — and finding value where few can find it. This Certified Value-Added Mastery Class possesses all the tools, blueprints and resources you will need to…

Identify the hidden profit potential in every value-added property…

Add value using our many tricks to ensure certainty that you can achieve commercial real estate success…

And emerge from each deal stronger, more successful, and more certain than ever before.

And, if you still aren’t convinced, here’s a brief snapshot of all the ways in which ACPARE’s Certified Value Added Transactions Mastery Class will empower you to:

- Select good deals from bad ones — from the get-go — and identify the hidden profit potential in each purchase

- Understand the key metrics to distinguish a value-added property from other property types

- Witness the role of value-added transactions within the capital strategy (and understand how and where these transactions “fit in”)

- Navigate problems in refinancing or selling your commercial properties like an adept sponsor (hint: this is where the paydays come in!)

- “Vet the deal” — an essential part of the total capital strategy

- Understand, scrutinize, and dissect the motivations of ALL parties involved in the transaction

- Comprehend the 5 Ways To Increase Revenue and the 4 Ways To Decrease Expenses to drive profits to YOUR pocket.

- Consult with others who are dealing with all the same exasperating problems in value-added (in addition to knowing yourself, you’ll see how to walk OTHERS through investing in value-added properties, step-by-step!)

- Recognize the 3 Property-Level Commercial Tests that will ensure you come out on top every time!

- Consistently sidestep the risk to bring your property to stabilization and build ENORMOUS wealth!

- Grasp the sources and uses of funds to magnify your profit potential to the MOST extreme levels

- Know the 3 Main Investment Types in Value-Added — and which will offer the greatest return

- Increase the property value by increasing the NOI (and how to maximize your profits while doing so!)

- Comprehend the loopholes to analyze and interpret the value-added market super effectively

- Invest, improve, refinance all the equity out, and own a cash-flowing asset with no equity investment!

- Value your property expertly to achieve the GREATEST return on investment

- Conduct a pragmatic analysis of the numbers involved; view the property & the numbers dispassionately (act with your head — not your heart!)

- Understand the 8 Key Formulas for Value-Added Success — useful for novice and proficient investors alike

- Detect a positive market, and recognize an advantageous investment when you locate one

- Know the intricacies of the 4 Vital Key Events that will bring your property to stabilization

- Study the rent roll to determine everything you need to know about the property tenants and leases

- Get out of value-added investments with GARGANTUAN profits (hint: start with the end in mind!)

- Recognize what needs to happen and calculate the probability of bringing your property to stabilization (let the metrics lead your decision-making process!)

- HIT THE COMMERCIAL REAL ESTATE “GRAND SLAM”

As an ACPARE Certified Value Added Transaction Specialist, you’ll have all the know-how to evade risk, identify opportunity, and maximize profits when investing in value-added commercial properties. You’ll be a trained master when it comes to evaluating properties and interpreting the market, and you’ll be the supreme, go-to authority for everything value-added.

To become a Full ACPARE Value Added Transactional Specialist NOW, simply choose your program below and then follow 3 Easy Steps...

How Does It Work?

Step 1. Take the Course

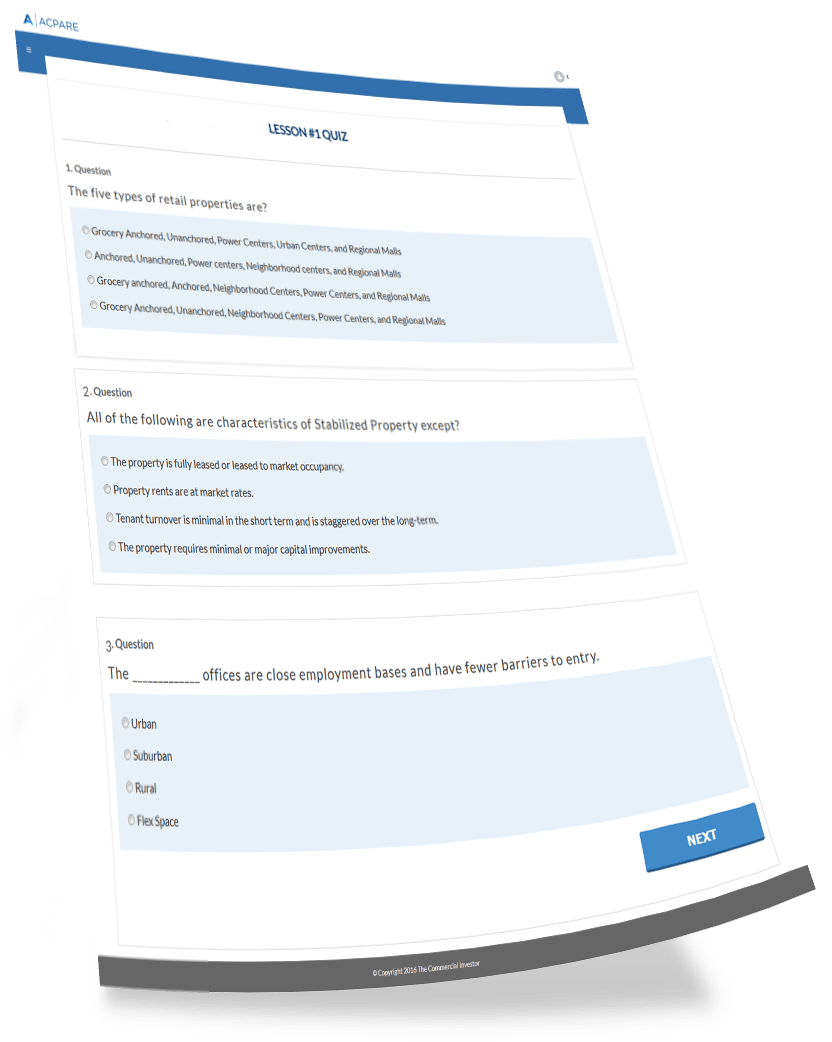

The Value Added Transaction Mastery course is 8 hours of video training lessons plus 9 handout downloads. You also get flowcharts and cheat sheets for quick, easy reference, plus lesson-specific quizzes and a final exam.

Step 2. Pass the Test

At the end of each module, you’ll take a brief quiz to ensure you have an understanding of the content and basic concepts covered in the lesson. Once you’ve completed all the quizzes, you’ll then take an online final exam.Upon successful completion, you’ll earn your Value Added Transaction Mastery Certification!

The exams are designed for your success. They’re not “tricky” (no SAT goofiness)… yet they do test your knowledge and comprehension of the material. A passing grade is 80. You can take the exam 3 times. If you don’t pass after 3 attempts, simply go back through the module prior to taking the test again.

The exams are not timed. They consist of 60 multiple choice and true/false questions. Allow 45-60 minutes to complete the exam. If you can complete the exam is a single sitting. Answers are saved if you need to finish at a later date.

The exams are designed for your success. They’re not “tricky” (no SAT goofiness)… yet they do test your knowledge and comprehension of the material. A passing grade is 80. You can take the exam 3 times. If you don’t pass after 3 attempts, simply go back through the module prior to taking the test again.

The exams are not timed. They consist of 60 multiple choice and true/false questions. Allow 45-60 minutes to complete the exam. If you can complete the exam is a single sitting. Answers are saved if you need to finish at a later date.

1

Step 3: Display Your Badge

Upon successful completion of the course and exams, you’ll receive a personalized certificate and badge.

Display your badge on your website, in your email signature, community portals, on your blog, and especially in your Linkedin profile and Twitter status.

AND…your digital certificate is full color, so print it up, frame it, and display it proudly in your home and office.

Display your badge on your website, in your email signature, community portals, on your blog, and especially in your Linkedin profile and Twitter status.

AND…your digital certificate is full color, so print it up, frame it, and display it proudly in your home and office.

Here’s What You Get

When you enroll today, you’ll get:

- The Value Added Transactions Total Mastery Course

- 8 Core Lessons

- 33 Modules

- 9 Handouts

- 4 Blueprints

- 8 Review Quizzes

- The Full, Easy-To-Reference Value Added Transactions Manual

PLUS, upon successful completion of the course and all the quizzes and final exam you’ll receive:

- A Wall Street-grade ACPARE badge––designating you as a Certified Due Diligence Master––that you can display on/in your website, email signature, and LinkedIn® profile

- A downloadable ACPARE certificate, to be displayed digitally – across ALL social media platforms such as Facebook, LinkedIn, email, etc.

- A dated and displayable ACPARE Certificate of Accreditation, signed by head executives and mailed directly to your home or workplace

- Status, acclaim, and recognition as an ACPARE Certified Value Added Transactional Specialist

Course Details:

Tuition: $995

Level: Intermediate / Advanced

Setting: Online / Virtual

Course Length: 8 hours

Expected Completion Time: 3-7 Days

Level: Intermediate / Advanced

Setting: Online / Virtual

Course Length: 8 hours

Expected Completion Time: 3-7 Days

Who Should Get Certified?

Certification is for anyone looking to command premium fees for capital placement, deal making, and their services when it comes to transacting and consulting on stabilized property investments. Your positioning in the marketplace matters. Like it or not, your prospects and clients WANT to do business with credible business owners they can trust.

Who Is Certification For?

- Startup investors

- Deal Makers

- Intermediaries

- Commercial Consultants

- Private Lenders

- Owners & Operators

- Sponsors

- Contractors

- Property Managers

- Anyone who knows Credibility matters

Why Should You Get Certified?

You get the same strategies, insider intel, tools, techniques, and resources we use in our business. All of it proven and time-tested.

So if you want to…

So if you want to…

- Get expert training and guidance

- Build a business you can be proud of AND get noticed

- Feel confident knowing that you’re qualified and prepared to quickly take on clients and projects

- Rise above the fold and distance yourself from the competition

- Attract ONLY high quality clients

- Know how to expertly parlay your intellectual capital

- Structure deals like a Wall Street pro

-

Charge highly lucrative fees for your advice and consultation…

When everyone on your team is in sync, can understand what you — their leader — is doing and thinking, productivity and incentive skyrockets.

With everyone in your office on the same page, using the same language, and possesses the same skills, your company becomes a formidable force in the marketplace.

Keep this in mind…there’s no rule that says you have to get certified or take the test.

You still have all the great content, training, and modules to enhance your team’s education. And the more specialized they are, the more you can charge for your services.

Whatever you choose, if you expect the best for your company and the most from your team, then this course and certification is for you.

With everyone in your office on the same page, using the same language, and possesses the same skills, your company becomes a formidable force in the marketplace.

Keep this in mind…there’s no rule that says you have to get certified or take the test.

You still have all the great content, training, and modules to enhance your team’s education. And the more specialized they are, the more you can charge for your services.

Whatever you choose, if you expect the best for your company and the most from your team, then this course and certification is for you.

...is Different

Are there other courses out there on Stabilized Property investing? Probably. But you won’t find anything that comes close to what you’ll get with this training.

The difference is, all of us here at The Commercial Investor, including our students and partners, are actual investors, in the trenches every day.

We raise capital, place capital, analyze and structure deals, buy and sell property, negotiate with institutions, family offices, and lenders, and pitch the ‘big boys.’

So…does this sound exciting to you? Is this something you want to be part of? If your answer is ‘yes,’ then you’re in the right place.

The difference is, all of us here at The Commercial Investor, including our students and partners, are actual investors, in the trenches every day.

We raise capital, place capital, analyze and structure deals, buy and sell property, negotiate with institutions, family offices, and lenders, and pitch the ‘big boys.’

So…does this sound exciting to you? Is this something you want to be part of? If your answer is ‘yes,’ then you’re in the right place.

Course Details

Lesson 1: Start Here

Section 1.1 - Orientation

Section 1.2 - Here’s What to Expect

Section 1.3 - Asset Types

Section 1.4 - The Total Real Estate Capital Strategy

Section 1.5 - Stabilized Properties: The What and Why

Section 1.6 - Rules of Investing

Section 1.7 - Sample Transaction: Stabilized Property Example #1

Section 1.8 - Sample Transaction: Stabilized Property Example #2

Section 1.2 - Here’s What to Expect

Section 1.3 - Asset Types

Section 1.4 - The Total Real Estate Capital Strategy

Section 1.5 - Stabilized Properties: The What and Why

Section 1.6 - Rules of Investing

Section 1.7 - Sample Transaction: Stabilized Property Example #1

Section 1.8 - Sample Transaction: Stabilized Property Example #2

Lesson 2: Real Estate “Whole Loan” Financing Continuum: The Lenders

Section 2.1- Real Estate Risk

Lesson 3: The Different Types of Real Estate Properties: The Assets

Section 3.1 - Stabilized Properties

Section 3.2 - Unstabilized or Value Added Properties

Section 3.3 - Opportunistic Properties

Section 3.2 - Unstabilized or Value Added Properties

Section 3.3 - Opportunistic Properties

Lesson 4: What is Permanent Financing?

Section 4.1 - Definition

Section 4.2 - Typical Permanent Financing Structure

Section 4.3 - Repaying the Permanent Loan

Section 4.2 - Typical Permanent Financing Structure

Section 4.3 - Repaying the Permanent Loan

Lesson 5: Types of Permanent Financing

Section 5.1 - Life Company or Portfolio Loans

Section 5.2 - Bank Loans

Section 5.3 - Commercial Mortgage Backed Securities (CMBS) or Conduit Loans

Section 5.4 - Agency Lenders: Freddie Mac (FHLMC), Fannie Mae (FNMA), & FHA/HUD

Section 5.2 - Bank Loans

Section 5.3 - Commercial Mortgage Backed Securities (CMBS) or Conduit Loans

Section 5.4 - Agency Lenders: Freddie Mac (FHLMC), Fannie Mae (FNMA), & FHA/HUD

Lesson 6: Analyzing Stabilized Properties

Section 6.1 - From the Owner’s Perspective

Lesson 7: Property Profitability

Section 7.1 - Cash-On-Cash Return

Section 7.2 - Leveraged Cash-On-Cash Return

Section 7.3 - Positive Leverage

Section 7.2 - Leveraged Cash-On-Cash Return

Section 7.3 - Positive Leverage

Lesson 8: How Much Leverage Will this Building Support?

Section 8.1 - Cap Rates: The Key to Income Property Value

Section 8.2 - Loan to Value: The Lender’s Key Metric

Section 8.3 - Debt Service Coverage Ratio (DSCR): Another Key Lender Metric

Section 8.4 - Amortization or Loan Constant

Section 8.5 - Solving for the Loan Constant

Section 8.2 - Loan to Value: The Lender’s Key Metric

Section 8.3 - Debt Service Coverage Ratio (DSCR): Another Key Lender Metric

Section 8.4 - Amortization or Loan Constant

Section 8.5 - Solving for the Loan Constant

Lesson 9: Permanent Loan Underwriting: Deep Dive on How the Numbers Work

Section 9.1 - Underwriting the Stabilized Loan

Section 9.2 - Tenant Assumptions

Section 9.2 - Tenant Assumptions

Lesson 10: Solving for the “Underwritten NOI”

Section 10.1 - Deductions

Lesson 11: Asset Class Review: All Commercial Properties Were Not Created Equal

Section 11.1 - Office Properties

Section 11.2 - Retail Properties

Section 11.3 - Industrial

Section 11.4 - Multifamily

Section 11.2 - Retail Properties

Section 11.3 - Industrial

Section 11.4 - Multifamily

Lesson 12: Conclusion & Looking Ahead

Section 12.1 - Conclusion

Course Details and Description

Lesson 1: Start Here

- 1.1 Orientation

- 1.2 Here’s What to Expect

- 1.3 Types of Commercial Real Estate Transactions

- 1.4 The Total Commercial Real Estate Strategy

- Capital Placement

- Asset Arbitrage

- Capital Formation - 1.5 Sponsor and Sponsorship Equity

- Sponsorship Equity Co-Investments

- Guidelines for Sponsor Co-Investment

- Where is the Equity Really Coming From?

Lesson 2: Value Added Real Estate

- 2.1 Value Added Basics

- 2.2 Value Added Investing vs. Stabilized Investing

- 2.3 Value Added Investing – Underwriting 101

- 2.4 The Secret to All Value Added Investing – Increasing Net Operating Income

- Revenue Events

- Expense Events

Lesson 3: Investor Transaction Selection Criteria

- 3.1 Follow the Numbers

- 3.2 Selecting the Right Investor

- Sponsorship

- Alignment of Interests

- Key Events

- The Back-Up Plan

Lesson 4: The Key Information for Making Good Investment Decisions

- 4.1 Capital Structure

- 4.2 Sources and Uses

- 4.3 Current and Historical Operating Statements

- 4.4 Rent Roll

- 4.5 Project Pro Forma

- 4.6 Exit Strategies

Lesson 5: Structuring the Transactions

- 5.1 Structural Incentives

- 5.2 Structural Penalties

- 5.3 Investment Performance Tests

- 5.4 Guarantees

Lesson 6: Exit Strategy Overview: Exit Types for Bridge & Mezzanine Loans

- 6.1 Permanent Loan Refinance Exit

- 6.2 Sale Exit

Lesson 7: Adding Value to the Property & Different Asset Classes

- 7.1 Improvements and the Budget

- 7.2 Adding Value to Different Classes

- Multifamily

- Retail Properties

- Office and Industrial Properties

Lesson 8: The Key Metrics for Good Decisions

- 8.1 Cash-on-Cash Return

- 8.2 Leveraged Cash-on-Cash Return

- 8.3 The Debt Service Coverage Ratio

- 8.4 Loan-to-Value

- 8.5 Price-per-Pound

- 8.6 Gross Profit (Whole Dollar)

- 8.7 Gross Profit Multiple

- 8.8 Cap Rate to Loan Basis (a.k.a. Debt Yield)

Your Instructor: Sal Buscemi

Sal Buscemi is the CEO of The Commercial Investor and managing partner of Dandrew Partners in NYC.

A former investment banker for Goldman Sachs in NYC, Sal left the company after 8 years to start his own commercial real estate hedge fund.

He raised $30 Million within 6 months. Sal has since raised close to $150 Million in capital for various private money pools and the JG Mellon fund.

Sal founded Dandrew Partners and Dandrew Media as vehicles for investing in real estate and publishing educational content for serious investors. His passion for teaching is rivaled only by his excitement to see his students succeed.

A former investment banker for Goldman Sachs in NYC, Sal left the company after 8 years to start his own commercial real estate hedge fund.

He raised $30 Million within 6 months. Sal has since raised close to $150 Million in capital for various private money pools and the JG Mellon fund.

Sal founded Dandrew Partners and Dandrew Media as vehicles for investing in real estate and publishing educational content for serious investors. His passion for teaching is rivaled only by his excitement to see his students succeed.

Frequently Asked Questions

Q: “How will this certificate help me?”

A: Most commercial investors learn by the seat of their pants. They hack their way through learning the ropes the hard way…through trial and error. And because there’s no system in place or way to test their knowledge of what they know, they either quit or burnout.

The certification program sets you on a deliberately designed and calculated path to success. You get a step by step training process to help you accelerate your learning curve and course of action.

So your certificate is actually a badge of accomplishment and achievement for taking the time to learn the content and material that helps you build your business AND bring in revenue in the shortest, quickest time possible.

There’s no mistaking who you are and what you represent to your prospects and clients when you’re certified. You BECOME the expert in their eyes. You ARE that trustworthy advisor, consultant, deal maker, and intermediary. You ARE the one person they rely on for guidance.

Display your badge and certificate proudly…and witness the results for yourself.

The certification program sets you on a deliberately designed and calculated path to success. You get a step by step training process to help you accelerate your learning curve and course of action.

So your certificate is actually a badge of accomplishment and achievement for taking the time to learn the content and material that helps you build your business AND bring in revenue in the shortest, quickest time possible.

There’s no mistaking who you are and what you represent to your prospects and clients when you’re certified. You BECOME the expert in their eyes. You ARE that trustworthy advisor, consultant, deal maker, and intermediary. You ARE the one person they rely on for guidance.

Display your badge and certificate proudly…and witness the results for yourself.

Q: How long does it take to finish the course and receive my certification?

A: That depends on you and your schedule. There’s no time constraint. You can go at your own pace. At the end of each module, you take a quiz.

In my experience, it’s best to set aside a few hours and go through as many modules and quizzes as possible in each sitting. This way, you COMMIT to absorbing all you can and finishing the course with a set deadline in place. Avoid dragging it out over weeks or months.

Remember, the course itself is only 8 hours. You can complete it in a day if you choose. Ideally, 3-7 days if you devote to it full time, 14 days if you commit to it part time.

If for any reason you can’t start the training right away after you invest in it, or you have to put it aside due to other commitments, no worries. The training is there for you for however long you need it.

In my experience, it’s best to set aside a few hours and go through as many modules and quizzes as possible in each sitting. This way, you COMMIT to absorbing all you can and finishing the course with a set deadline in place. Avoid dragging it out over weeks or months.

Remember, the course itself is only 8 hours. You can complete it in a day if you choose. Ideally, 3-7 days if you devote to it full time, 14 days if you commit to it part time.

If for any reason you can’t start the training right away after you invest in it, or you have to put it aside due to other commitments, no worries. The training is there for you for however long you need it.

Q: Am I guaranteed a certificate and badge if I take the class.

A: No. You must pass the quizzes and final exam to get certified. It’s only fair to your clients and prospects that you know how to best serve them. You can’t buy a certification, much like you can’t buy a diploma from Wharton or Harvard.

Your certificate represents the time and effort you put into the course, and your understanding of the material. I that weren’t the case, your certificate wouldn’t be worth the paper it was printed on.

Your certificate represents the time and effort you put into the course, and your understanding of the material. I that weren’t the case, your certificate wouldn’t be worth the paper it was printed on.

Q: I don’t care about the certificate. Can I just audit the class?

A: The class and certification are bundled for $995. And you’re also eligible to take the exam up to 3 times. This will change soon and when it does, the price will also increase. We are not currently offering audits of the class.

Q: How difficult is the test?

The quizzes and exams are designed to test your knowledge on the lessons you take. The questions were in no way intentionally created to “trick” you. I have every confidence that when you go through the lessons, take notes, and focus (without distractions…like browsing websites, surfing Facebook, answering phone calls), you’ll do fine.

Are the questions challenging? Yes. Anything worth doing is worth doing well. If it were easy, everybody would be doing it. The strategies and insights you get with this training are proprietary, not like other commercial courses you may have taken. The material will help you stand out from your peers and the competition, and the quiz questions will reflect and support you in that arena.

Are the questions challenging? Yes. Anything worth doing is worth doing well. If it were easy, everybody would be doing it. The strategies and insights you get with this training are proprietary, not like other commercial courses you may have taken. The material will help you stand out from your peers and the competition, and the quiz questions will reflect and support you in that arena.

Q: What if I fail the exam? Can I retake it?

A: Absolutely. You can take the test up to 3 times. If you don’t pass the exam after the third attempt, you’re required to retake the training…which you can do for free…plus all the lessons and quizzes prior to taking the final exam.

Copyright © 2016. The Commercial Investor. All Right Reserved. - Terms & Conditions - Earnings Disclaimer - Privacy Policy